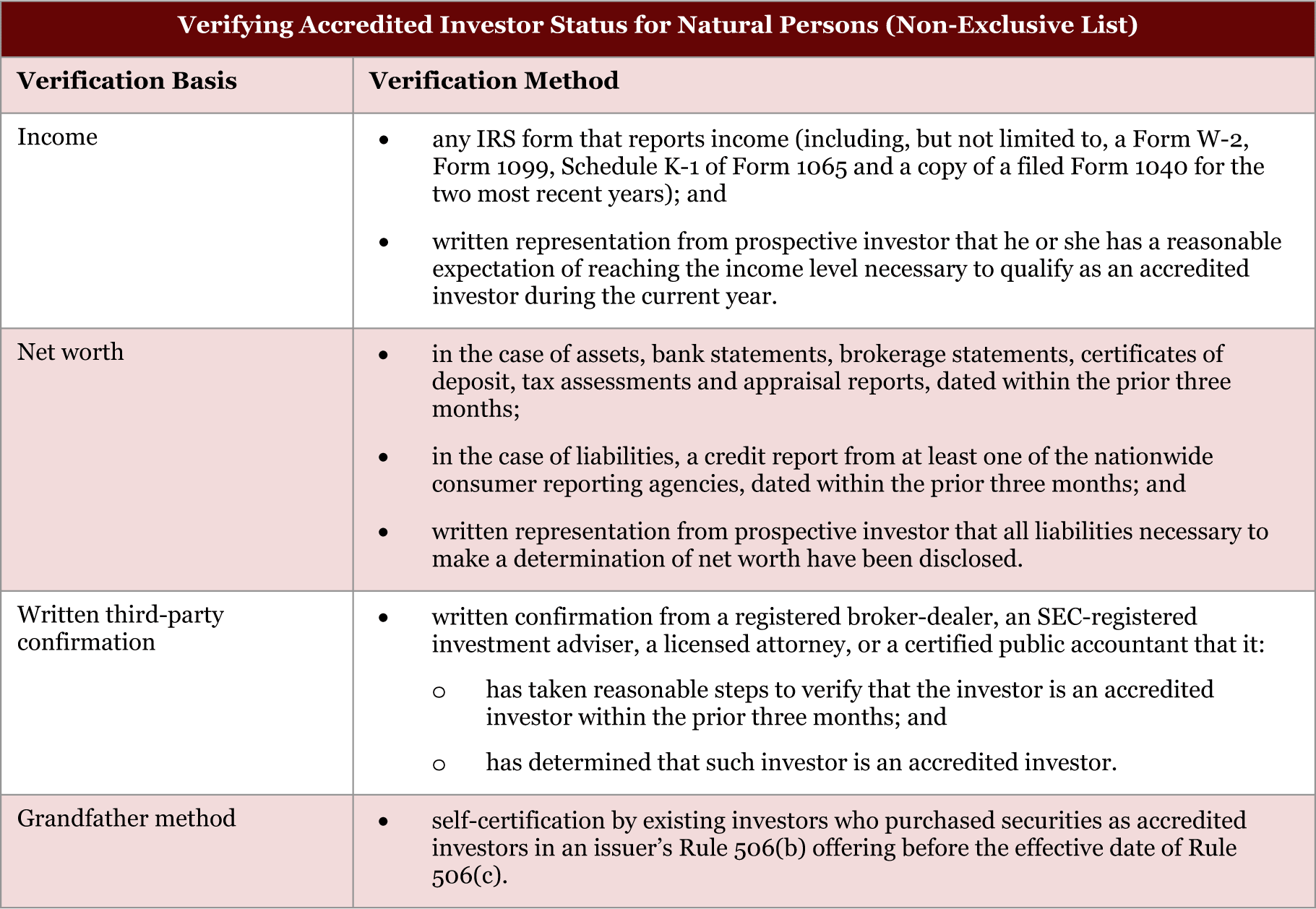

D in regard to any person who purchased securities in an issuer s rule 506 b offering as an accredited investor prior to september 23 2013 and continues to hold such securities for the same issuer s rule 506 c offering obtaining a certification by such person at the time of sale that he or she qualifies as an accredited investor.

Reg d rule 506 d.

This rule a product of the jobs act became effective on september 23 2013 and is the original source of the bad actor rule.

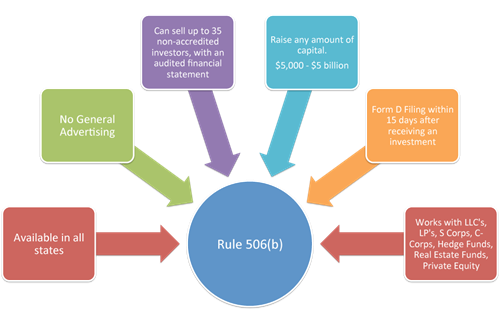

This rule permits sales of an unlimited dollar amount of securities without securities act registration provided certain requirements are satisfied.

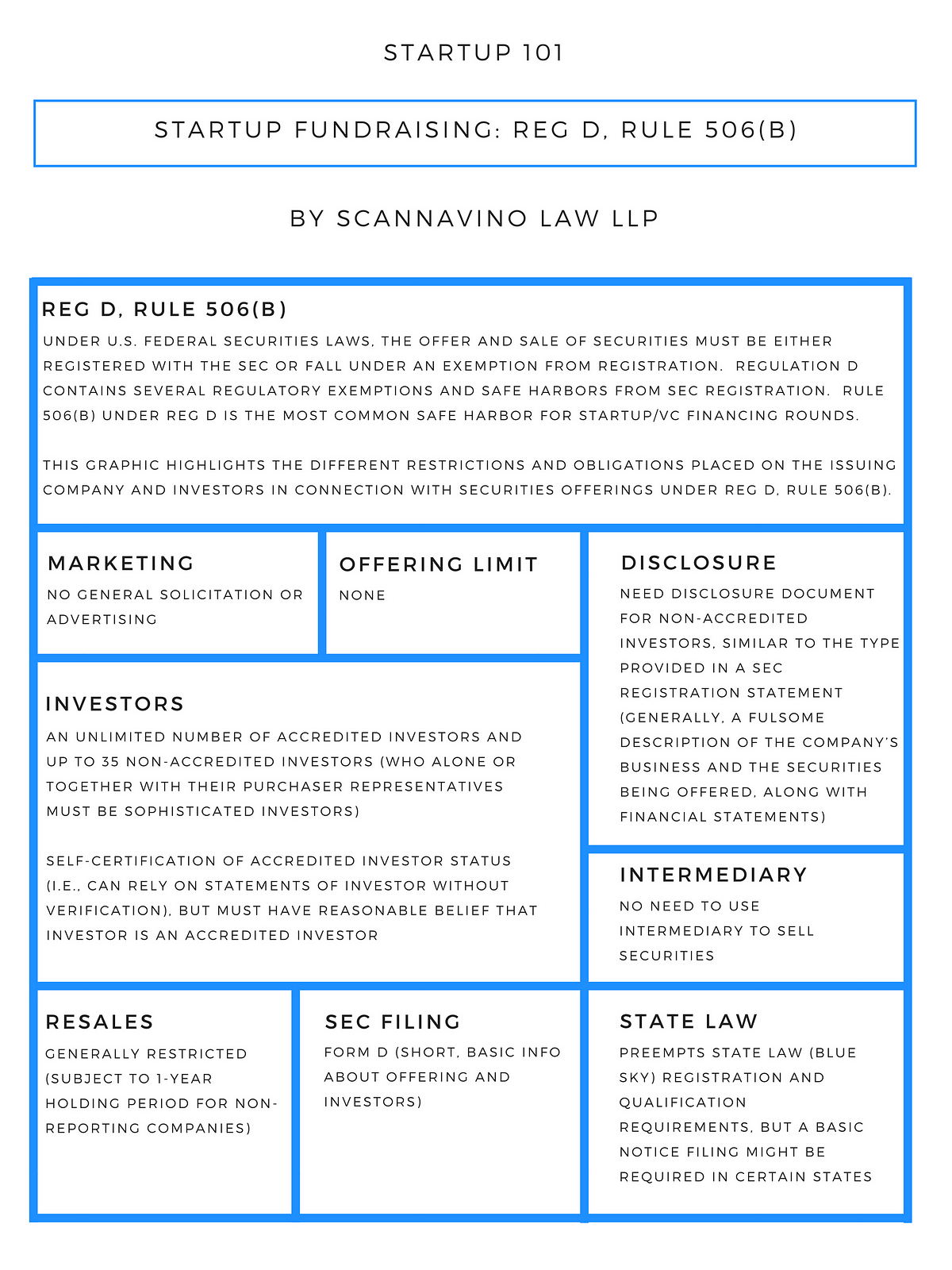

Under rule 506 b a safe harbor under section 4 a 2 of the securities act a company can be assured it is within the section 4 a 2 exemption by satisfying certain.

Under rule 506 b a safe harbor under section 4 a 2 of the securities act a company can be assured it is within the section 4 a 2 exemption by satisfying certain.

Rule 506 of regulation d is considered a safe harbor for the private offering exemption of section 4 a 2 of the securities act.

Rule 506 is the most commonly used regulation d exemption.

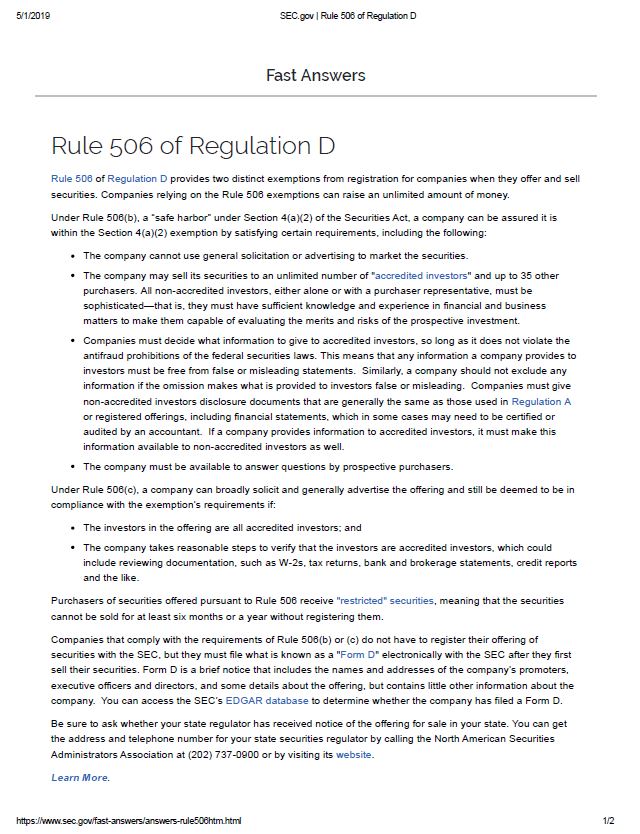

Rule 506 of regulation d provides two distinct exemptions from registration for companies when they offer and sell securities.

Rule 506 of regulation d is considered a safe harbor for the private offering exemption of section 4 2 of the securities act companies using the rule 506 exemption can raise an unlimited amount of money.

Rule 502 contains the general conditions that must be met to take advantage of the exemptions under regulation d.

There are actually two distinct exemptions that fall under rule 506.

Companies relying on the rule 506 exemptions can raise an unlimited amount of money.

For small issuers the amount raised is typically less than 2 million.

A company can be assured it is within the section 4 2 exemption by satisfying the following standards.

Rule 501 of reg d contains definitions that apply to the rest of reg d.

Regulation d reg d is a securities and exchange commission sec regulation governing private placement exemptions.

Reg d is composed of various rules prescribing the qualifications needed to meet exemptions from registration requirements for the issuance of securities.

Rule 506 c allows for general solicitation of accredited investors.

Reg d offerings are advantageous to private companies or entrepreneurs that meet the requirements because funding can be obtained faster and at.

Rule 506 of regulation d provides two distinct exemptions from registration for companies when they offer and sell securities.

Companies relying on the rule 506 exemptions can raise an unlimited amount of money.

Rule 506 is by far the most widely used regulation d exemption for conducting private placements according to the sec about 90 95 of all private placements are conducted pursuant to rule 506.

Companies relying on the rule 506 exemption can raise an unlimited amount of money.